Get Professional Tax Help in Houston

There’s no technology equivalent to real-world experience. Filing taxes isn’t a one-size-fits-all process. Online software might be cheaper, but you run the risk of mishandled deductions and miscalculations.

EZQ Group offers expert tax preparation services in Houston. Forget worrying about entering the information correctly or trusting software to submit your forms – we handle everything for you. Feel confident that you’re protected from audits, errors, and lost funds.

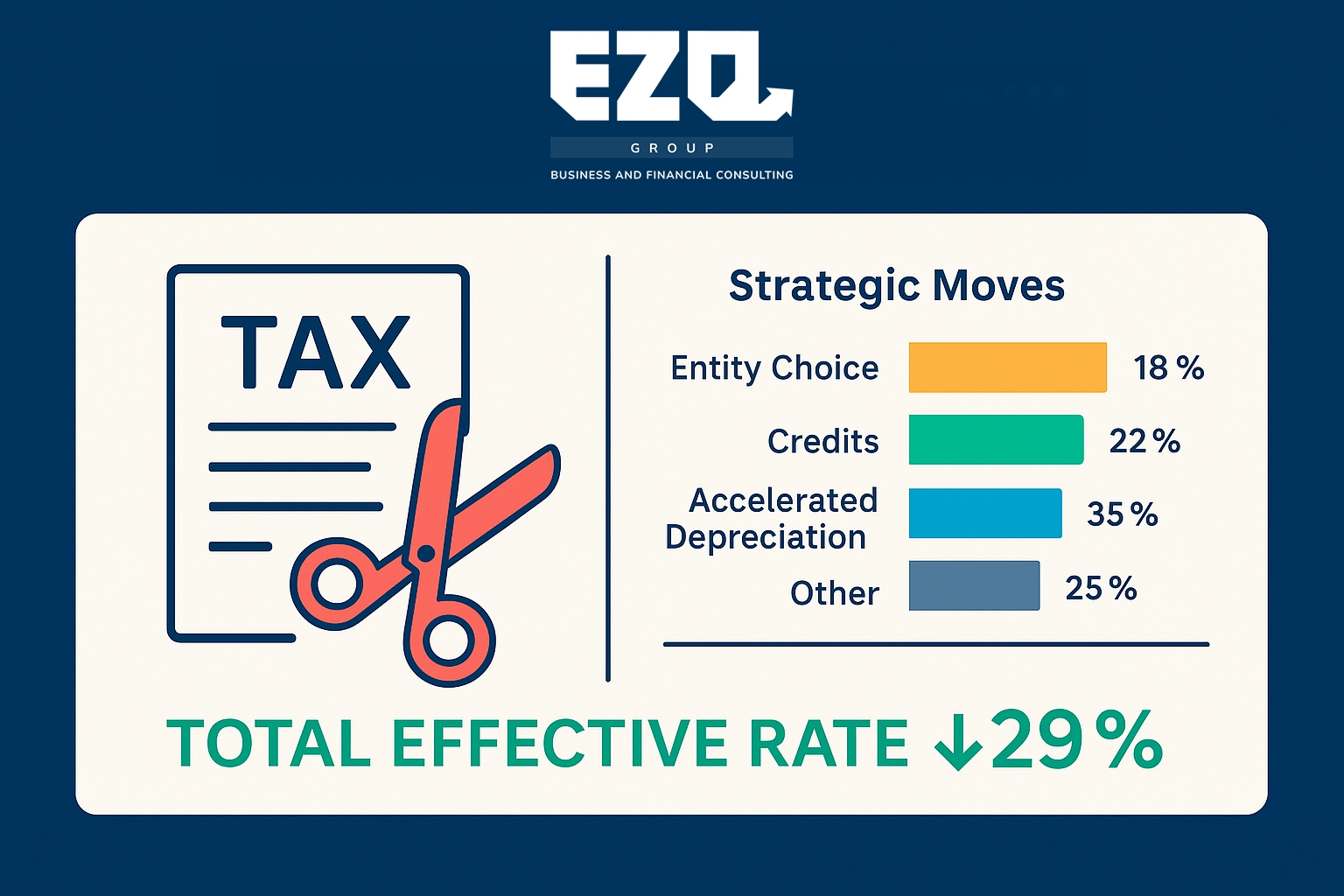

Customized Business Tax Preparation

Let’s skip the cookie-cutter tax plans and develop a system that works for you. When our clients need help with taxes, we build a customized process that abides by the latest rules and regulations. At the same time, we keep an eye out for new legislation that could benefit (or hurt) them. Everything, from paperwork to clients’ tax returns, is done with years of expertise.

Get Your Tax Returns Quickly

A crucial element of doing your taxes is understanding tax return preparation. The longer you’re waiting on that refund check, the less you’re doing with your money. If you turn to us for tax help in Houston, we provide expedient tax refunds with quick online filing. We’ll ensure that you get your money as soon as possible – you deserve it.

Customized Business Tax Preparation

Let’s skip the cookie-cutter tax plans and develop a system that works for you. When our clients need help with taxes, we build a customized process that abides by the latest rules and regulations. At the same time, we keep an eye out for new legislation that could benefit (or hurt) them. Everything, from paperwork to clients’ tax returns, is done with years of expertise.

Get Your Tax Returns Quickly

A crucial element of doing your taxes is understanding tax return preparation. The longer you’re waiting on that refund check, the less you’re doing with your money. If you turn to us for tax help in Houston, we provide expedient tax refunds with quick online filing. We’ll ensure that you get your money as soon as possible – you deserve it.

Why Turn to EZQ Group for Tax Preparation Services?

Millions of taxpayers turn to professionals when filing their taxes, but not all sources of professional tax help are equally trustworthy. You need to feel comfortable turning over your most valuable information to your tax partner, including personal data like Social Security numbers.

At EZQ Group, we take client safety and satisfaction very seriously. We will never mislead clients, nor will we misappropriate or compromise your important information. Our goal is to offer tax services in Houston, TX that you can trust. We’re here to help – and you can rely on that.

Our Tax Preparation Services in Houston, TX

- Business Tax Preparation

- Individual Tax Preparation

- Multi-state Tax Preparation

- Tax Refunds with e-file

Are you on the hunt for local tax preparation services?

Don’t hesitate to reach out to our team at EZQ Group or give us a call on 346.389.5215. We offer 100% free consultations at your convenience.

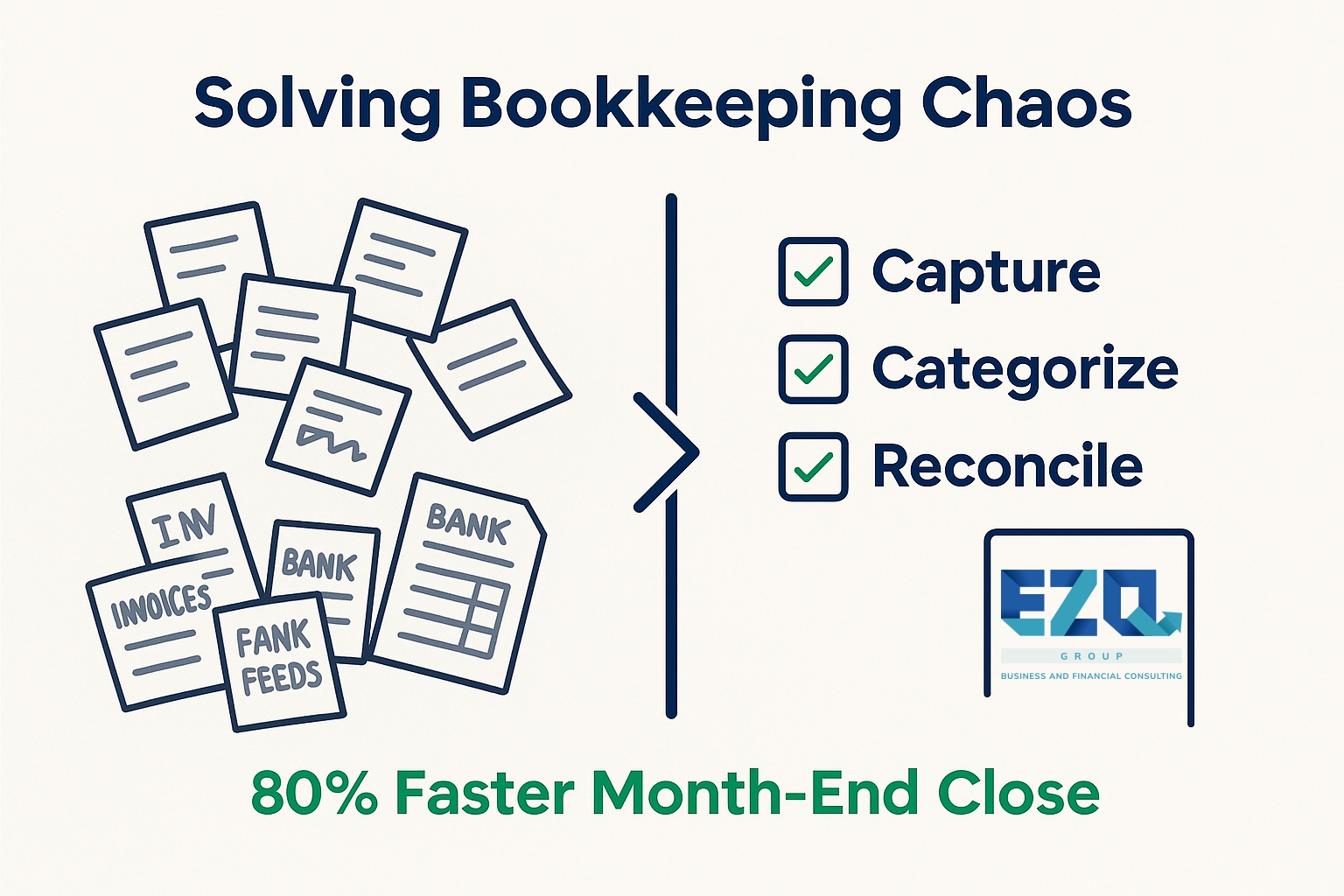

Why Let Us Take Care of Your Books?

A free no-obligation discussion about your business requirements

Fixed accounting fees agreed in advance and not dependent on income level

An accounting practice with 10 years experience

Personal account manager

Same day company formation normally within 2 hours

VAT registrations and advice

Tax planning for record keeping

Company Forecasts

Online business banking